Today's note is on Sight Sciences, and my what a good year they have had. Sight Sciences is a smaller medical devices company focused on the Ophthalmology field - specifically Minimally Invasive Glaucoma Surgeries (MIGS). They currently have two major products: The OMNI Surgical System (a clever handheld tool designed for complex microcatheterization of eye anatomy) and the TearCare. Overall, I rate Sight Sciences as a great company with some powerhouse engineers in Ophthalmologic care, but overpriced. The OMNI isn't the first medical device from Sight, where the company clearly understands, addresses and enhances the advancing surgical field for glaucoma and eye health. The FDA recently approved OMNI for expanded indications for canaloplasty followed by trabeculotomy, with the company pushing for more standalone approval as a "preventative" measure for increasing ocular pressure leading to glaucoma, vision changes/loss, and overall decreasing eye health. TearCare appears to be a fancy hot compress tickling a serious unmet need in ocular-care in relations to dry eye. While OMNI is poised for widespread acceptance in MIGS, I fundamentally disagree with leading financial models asserting oversized Total Addressable Markets as viable. Furthermore, the TearCare system is a technological-novelty without a serious market, let alone a $10 billion one.

Medicine is rapidly evolving, procedures done a decade ago are gosh, and procedures done now were unimaginable then. Reviewing clinical glaucoma protocols and current literature on treating related conditions made it clear that Ophthalmology is no exception. One publication just a few years ago made a clear delineation that canaloplasty could be a superior method for reducing ocular pressure long-term and without invasive surgery, but it required surgeons to utilize both hands for the microcatheter - a clear strain that required precision and experience. From there, reviewing primary literature sources for the OMNI yielded a similar gem - a genuine appreciation for Sight Sciences' previous equipment in advancing glaucoma surgical care. I can't pinpoint one team member that makes the magic happen - the CTO is a ophthalmology surgeon himself, oversees the development of Sight's programs, likely creating the tools he wants to use himself. The CEO has a long history with successful medical device programs, and got his career starts in NIH labs. The CMO is a lifetime innovator in ophthalmology, with an incredible career advancing glaucoma and eye health for over three decades. OMNI isn't a complex tool, and it's not meant to be - this was made specifically for the surgeon by surgeons trying to make the operation easier.

MIGS have increased dramatically in proportion to other Glaucoma surgeries, but 2017 saw just over 170,000 glaucoma procedures billed to Medicare. 2008 to 2016 saw a 1% CAGR in total operations, compared to ~9.5% for MIGS through the same period, to a total of 58,000. This is unsurprising given the number and clinical efficacy of MIGS options compared to cataract surgery, but highlights the issues with a massive TAM that isn't. Even in an environment of increasingly geriatric-populations combined with staffing shortages pushing towards minimally invasive procedures done in clinic or out of hospital, the money doesn't make sense. In fact, I would put more weight on a hard-cap for healthcare growth as the trend of missing preventative appointments continues - leading to an increase of symptom severity potentially pushing more towards invasive surgeries offering big fixes. OMNI has been found to reduce ocular pressure >20% in >60% of patients, with some studies suggesting better results with greater patient selection. Interestingly, most reports stressed the ease of use of the tool, and that training will not be a large barrier towards adoption.

Financials look great, not only does Sight Sciences go into more detail than other companies, they are more forthcoming with critical information in forecasting profits. Sight sells the OMNI tool with single-use reagents, at massive margins (87+% with projected better given a switch to a larger-scale manufacturer in Asia). In fact, just the presentation of that information is key in several ways: First, the company bringing on a second manufacturer in Asia creates a thread to watch - switching manufacturers can always cause problems, and Sight's ability to foresee and prevent are good to look out for. Second, as supply-chains continue to evolve globally, identification of their Asian manufacturer allows investors to be one-step ahead of major supply-deficit announcements. Still, basic arithmetic yields great statistics for Profit, seeing double the revenue increase as cost of goods means the company has manufacturing inflation under control, and is excelling at scale. The company grew dramatically in the year, reasonable, and now they are cutting back, also reasonable - but these were not done at excessive booms and busts making a distinction between themselves and sloppy-peers like Peloton. Still, the company has some bad debt agreements, with LIBOR plus 6%/4.5% (non-revolving/revolving respectively) coming due December this year with a chance to push 1-2 years. Hammering down on this, the underwriter appears to be Apollo, and that is a big strike for me. The second strike is Operating Expenses need to come down a lot more than the cuts they have made, especially in a major-recessionary environment. Greed is a foul, but if it maintains that'll be a strikeout. Almost every company took the bull market of 2020-2021 by the dollar sign, Sight Sciences used it to IPO to an incredible $240+ million payday with a $6.2 million compensation bonus this year, well in excess of norms (and possibly capital runway).

I expect considerable growth and breakthrough in the MIGS population, especially as the FDA continues to greenlight the OMNI for standalone procedures, combined with field-exposure. However, this isn't a $6 billion TAM for Sight Sciences. At relative maximums, OMNI has a soft-10-fold population growth cap in Surgeons utilizing the tool, with the single-use reagents making up continuous revenue. This would result in a diminishing growth curve for revenues, likely seeing peak OMNI sales in 2024-2025, with continued reagent sales capping shortly after. Again, this analyst does not value the TearCare system (at all), which fits with the forecasted guidelines from Sight Sciences where an overwhelming amount of revenue is from OMNI, and not the TearCare. Given recent moves to cap medical care inflation, and Sight Sciences business being primarily American, I would ignore excessive CAGRs in other analyst's models and focus on reasonable geographic expansion. With Selling, general and administrative costs nearly double last years, I expect a significant push into international markets leading to expansive revenues in the coming quarters - muted by the eurozone's and the world's depressionary growth. Sight Sciences doesn't have to work hard to prove their tool is the go-to, they need to prove Canaloplasties are - meaning a prolonged clinical publication timeline with delayed adoption without major industry-group recommendations.

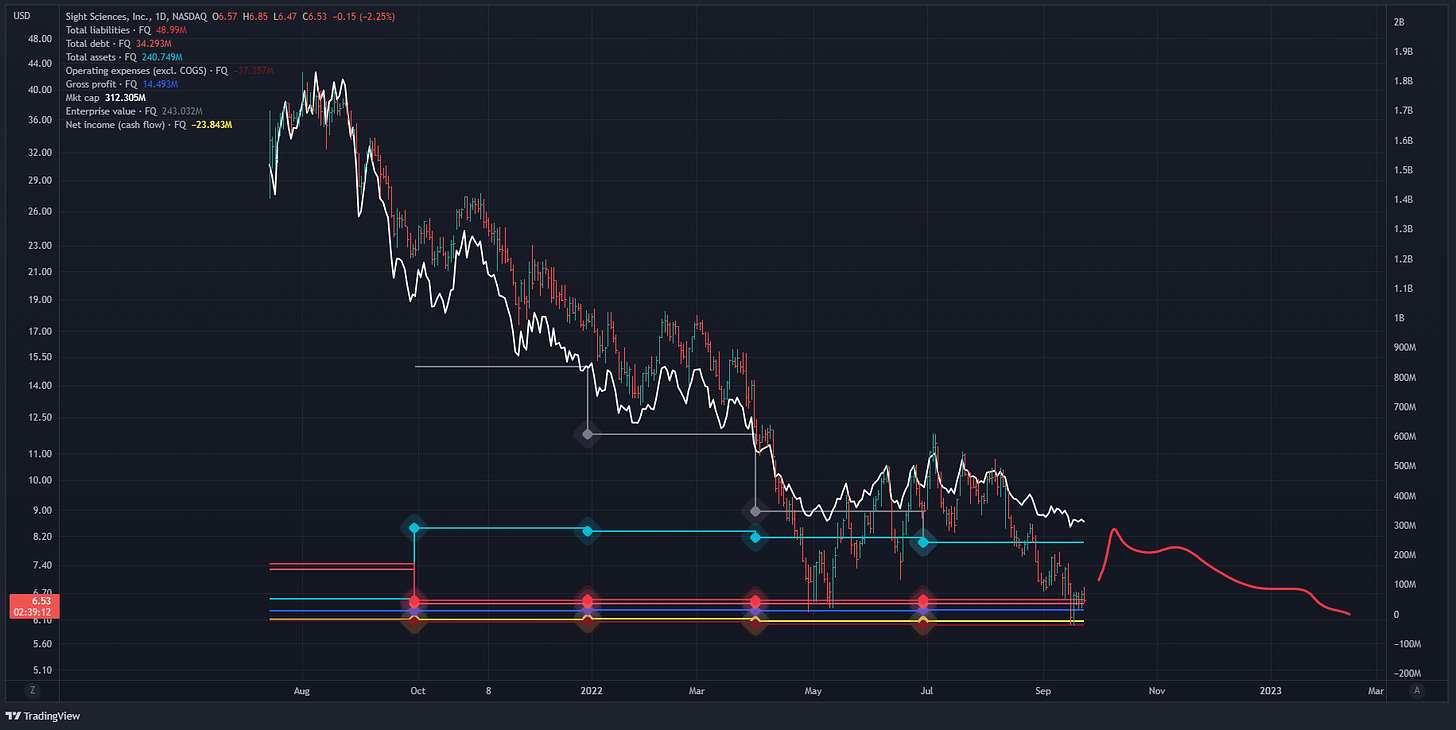

Using a fiscally conservative model of valuations at 5x forward gross profits, I believe Sight Sciences market capitalization will be between $150-200 million within the next 2 year timeframe, with the potential for 10-20% growth per year after given a natural progression of macroenvironment conditions. The company has enough cash to ride for a few years given measures for capital preservation while still focusing on building out networks, namely towards international markets with a special emphasis on targeting high level ophthalmology conferences and societies. While China's economy is undergoing tectonic shifts, they and India are still one of the biggest markets to enter - and a strategic partnership with appropriate domestic companies and agencies would be a huge move towards forecasting increasing future profits. I believe the stock price still has 35% downside within the acute term, where any negative financial surprises could lead to a 70% loss. Furthermore, various market bottoms provide good openings for forward-thinking Private Equity companies focused on healthcare, or public companies looking to buy an ophthalmology-unit. Because at the end of the day, OMNI is a great tool, but the engineers are better. As the ophthalmologic field continues to evolve in glaucoma care, I expect the company to have their finger on the pulse, and making great tools to help.